A large fraction of the world’s stock market value is concentrated in a relatively small number of big American tech companies. Those companies are spending a lot on AI. If that investment proves uneconomic, how bad is it for them?

I am not going to try to decide how likely it is that this is a bubble, or how much of the investment could turn out to be wasted. Let’s just suppose that it can and does burst. OpenAI is losing $3 for every $1 of revenue that it makes (ref) so, if the technology does not improve considerably, the cost to access the technology will increase at some point both to cover costs and to start generating the large returns that current investors are expecting. That could leads to the reverse of the Jevons paradox outcome: the tech is not efficient enough, so we end up needing a lot less of it than we think. Companies still need interns and juniors, and may just switch back to having interns and juniors taking meeting notes and writing draft documents instead of having generative AI do it.

Of course that is a pessimistic scenario.

This is not personal investment advice; I am not a certified financial advisor.

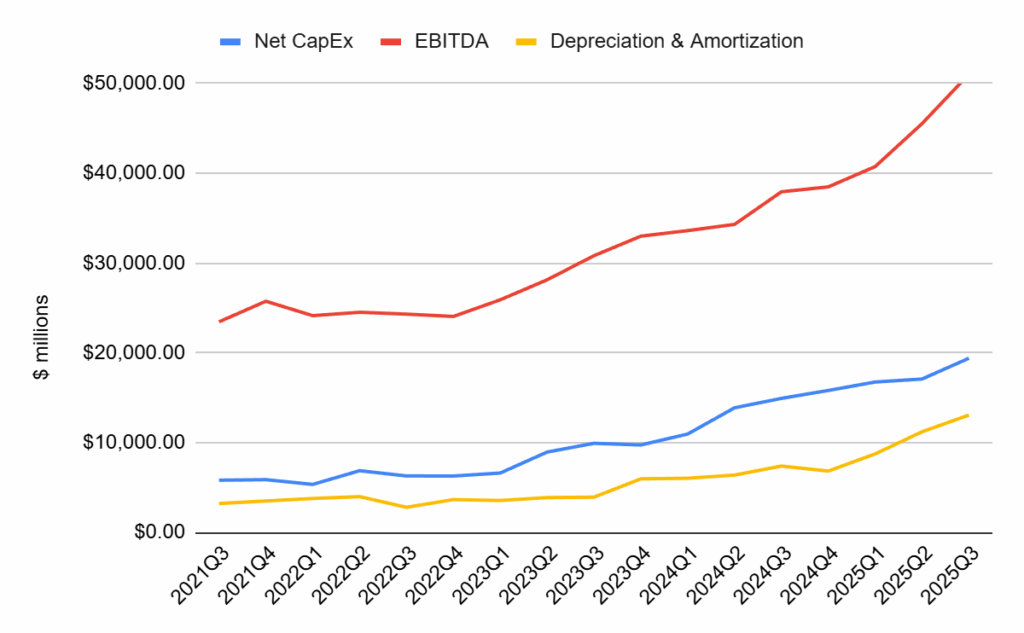

Note: in the graphs below, I show Earning Before Interest, Depreciation and Amortization (EBITDA) vs Capital Expenditure (CapEx). EBITDA is a bad measure of the profitability of a company in general: it is profit before CapEx, which loosely means the profit that a company would be making if it never had to renew or add to its stock of buildings and equipment. But it is a better measure to compare to CapEx than cashflow or profit, since these already have CapEx (or its profit equivalent, depreciation) subtracted.

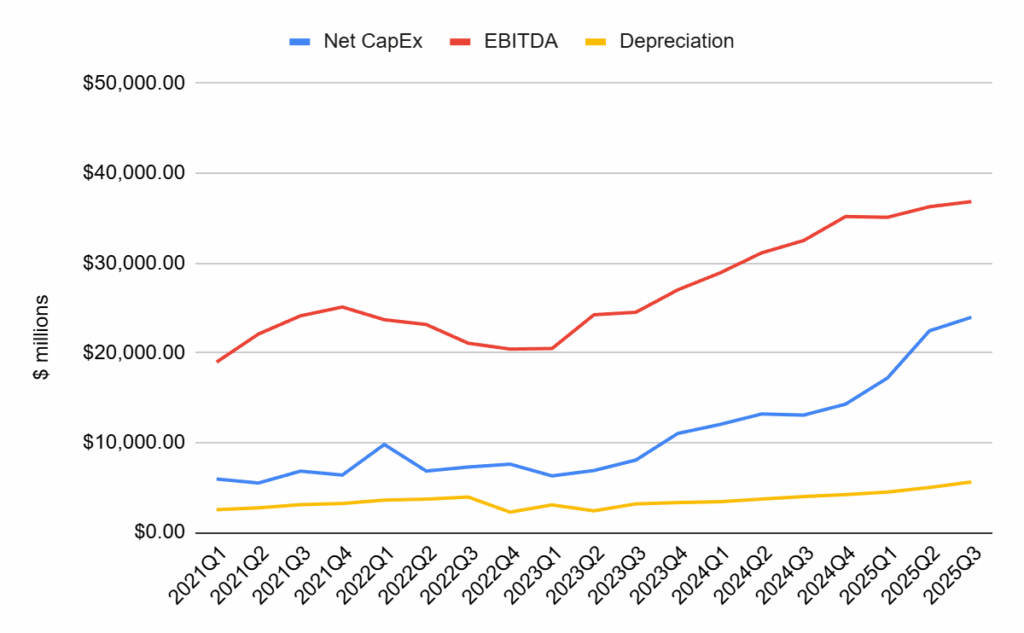

Alphabet (ref): The scale of Google’s spending is astounding to me. Alphabet had $97B of property and equipment at the end of 2021; it is on track to spend $85B on new property and equipment in 2025 alone. That’s nearly a whole 2021-Google built in 2025, on top of already high spending in 2024. And I thought Google was big in 2021. Of course, Alphabet may be getting a lot less than a 2021-Google for its money, given inflation in costs to buy this gear due to the bubble.

As a result, Google’s CapEx is far ahead of depreciation; this spending will start to weigh more on profits over time if it continues. But it is clearly affordable: Alphabet is spending less than its free cashflow on CapEx.

A bursting of the AI bubble would hurt Alphabet more from the effect of a recession on the advertising side, than from the effect of any mothballed datacenters. With Alphabet on a p/e of 30, investors buying in now would probably lose out significantly in the event of the bubble deflating.

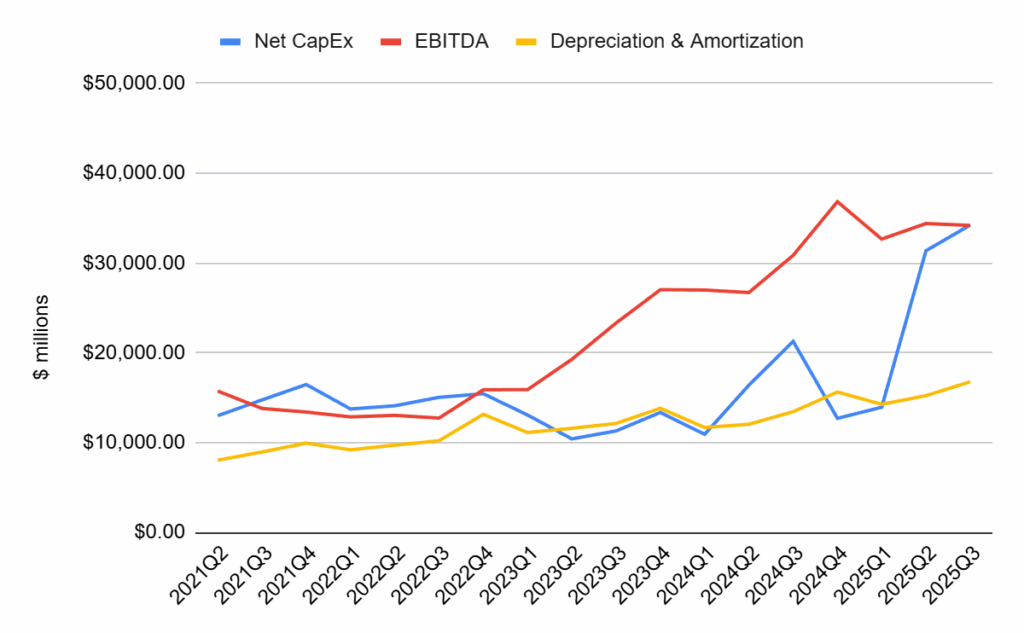

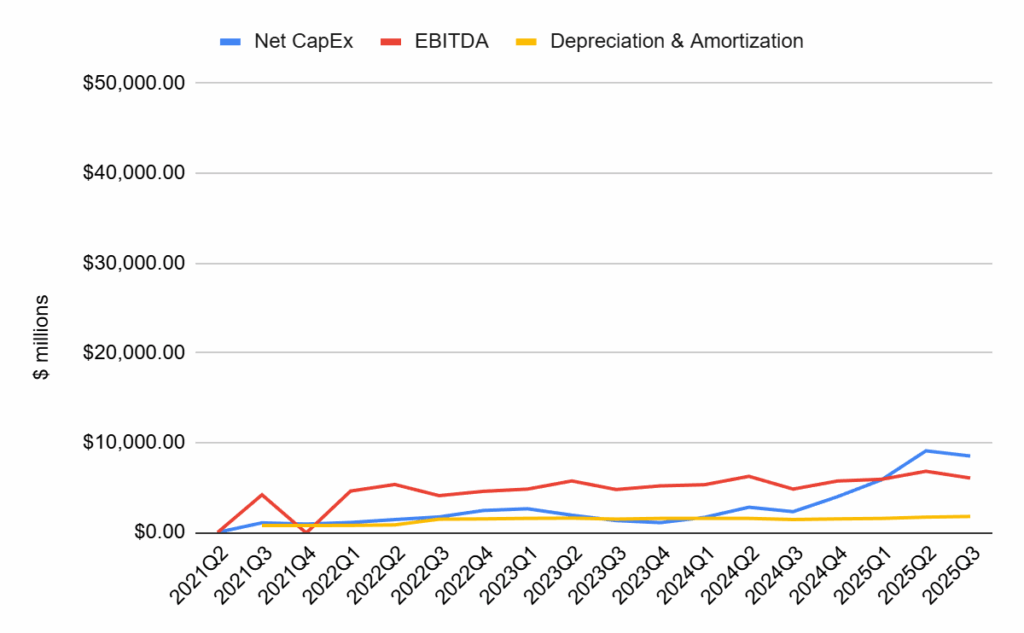

Amazon (ref): Amazon has a similarly large increase in CapEx, though from a substantially higher base of spending and equipment. This graph is for the whole business, retail and cloud together.

Again, clearly affordable, though Amazon is now spending almost its whole cashflow on the buildout.

Amazon is on a high p/e for a business that looked mature a few years ago.

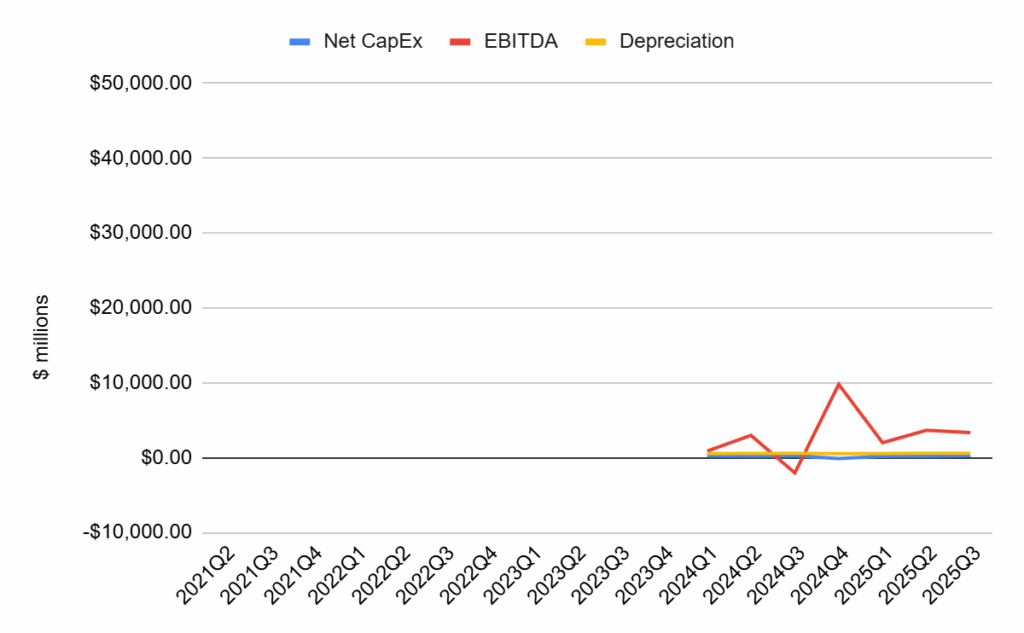

IBM (ref): spending less than depreciation, which usually means that a business is not even trying to renew its equipment in a timely manner. Having seen the most recent 2 years, I did not bother to look back further through their older accounts.

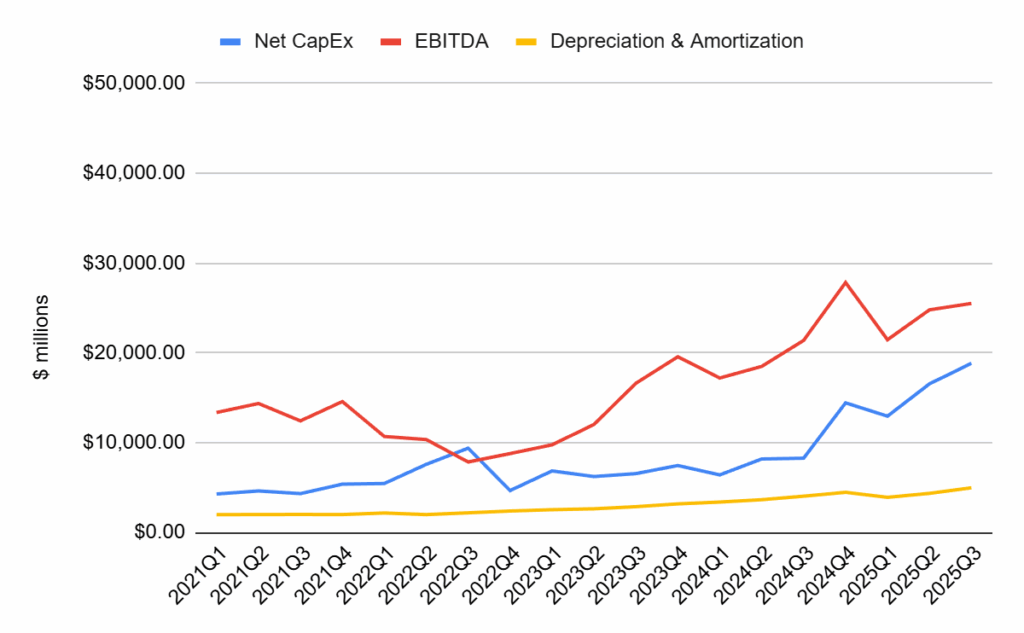

Meta (ref): Meta is unusual in this cohort, because it is already in the middle of a large investment in its Reality Labs as its AI spending starts to ramp up. Meta lost $16B on Reality Labs in 2023, $18B in 2024, and (in its last annual report) was expecting to lose more in 2025.

But I have been wrong about Meta every time that I looked at it: I laughed at their IPO, thought the Cambridge Analytica scandal would see all users desert them, and thought the Reality Labs spending was ruinous. But Meta’s family of apps makes so much money that the business is fine. Even if both Reality Labs and superintelligence are 100% writeoffs, the money spent per quarter is less than the cashflow from their family of apps. Meta only just stopped buying back $10B of shares per quarter; they are at worst burning investors’ money.

Meta is trading only on a p/e of 21 currently, meaning they have less far to fall than their competitors if the bubble bursts. If the bubble bursts and causes a recession, that causes more harm to Meta’s advertising revenue and short-term pain for investors than anything directly related to AI.

Microsoft: MS has the safest-looking position of the major companies here. Their spending is increasing a lot, but it is increasing somewhat in line with their operating cashflow. Their cashflow remains healthy despite the AI spending, and the business itself would not suffer much directly from a bursting of the bubble.

Microsoft trades at a p/e of 36 currently, so investors that buy in at current levels have a lot to lose if the bubble burst or there is a serious economic downturn.

Oracle: the one company here that is betting the business itself on AI. CapEx is exceeding cashflow, and this is only the beginning: Oracle projects spending of $300B over the coming years. If OpenAI can pay for it.

Oracle is also leasing its datacenters, which suggests to me that they are buying $300B of servers and chips specifically. Nvidia chips are probably (citation needed) the most cost-inflated part right now, and the part that could end up being written off much faster than, say, a datacenter building if the bubble bursts.

Oracle sees a chance to catch up in the fight for Cloud market share, I assume, and is betting big on this one.

Data here, taken from public financial statements.

Apart from Oracle, none of these companies are endangered as businesses by their AI investments. Investors buying in now are paying a high price if the AI investments fail to pay off, and valuations could fall substantially. But this would not look much like the dotcom crash, if it comes to that.