The accounts for the UK’s Asset Projection Fund for 2025 are released.

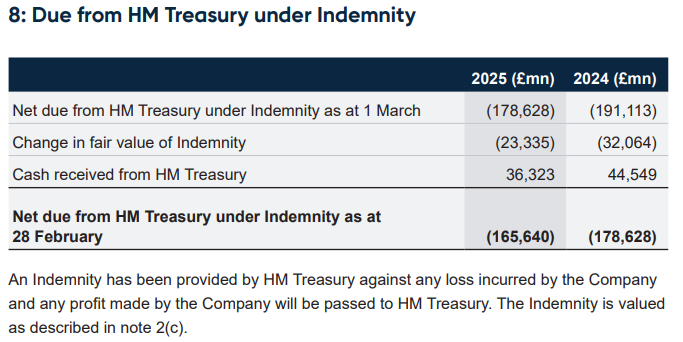

Something that I did not mention in my last post is that the APF accounts are presented in a rather obfuscated fashion. Specifically, the Bank is the legal owner of the APF’s share capital; but the Bank is not the beneficial owner since the Treasure underwrites losses and redeems the profits. So the reported profit/loss, to the legal owner, is always 0, and one has to look at Note 8 to see the beneficial owner’s profit or loss:

The bad news: projected losses increased by another £23B (before this year’s payment from the Treasury). That’s an increase added to the £178B of mark-to-market losses estimated in last year’s accounts.

The good news: looking only at cashflow, the Treasury had to transfer only £36B to the APF this year, down from £45B last year. That still hurts when the government is struggling to make just £5B/yr in savings on the welfare bill, but it hurts a bit less at least. That money is mainly to meet the £20B/yr deficit in interest payments (the shortfall in payments received on gilts owned vs payments owed on the loan from the Bank).

The tangible size of the APF decreased by £78B to £490B. Currently the APF has a gross valuation, ignoring liabilities, of £656B, roughly 1/4 of which is those mark-to-market losses owed to it in future under the Treasury guarantee.